The Most Underrated Credit Card You’ve Never Heard Of

Update (7/14/25): Citi has removed the application page for the Shop Your Way Mastercard, so new applicants can no longer apply for the card at this time.

What do you call a secret cash cow masquerading as an ordinary credit card? The Citi Shop Your Way Mastercard.

This content is for informational purposes only and should not be considered financial, investment, tax, or legal advice. You should consult a qualified professional before making any financial decisions. Some posts may contain affiliate links, meaning I may earn a commission if you sign up or make a purchase through my links, at no extra cost to you. All recommendations are based on my research and personal experience. Please conduct your own due diligence before making any financial decisions.

What is the Citi Shop Your Way Mastercard?

The Citi Shop Your Way Mastercard (SYW) is a lesser-known card in Citi’s lineup, earning 5% in points on gas, 3% at grocery stores and restaurants, and 1% on everything else. These points can be redeemed for gift cards to popular merchants like Amazon, Apple, prepaid Mastercards, and more.

That said, the real value of this card lies in the lucrative spending offers Citi quietly sends to cardholders—hidden promos that aren’t publicly advertised, leaving most people unaware they even exist.

With that in mind, let’s take a closer look at these secret offers.

Spending Offers

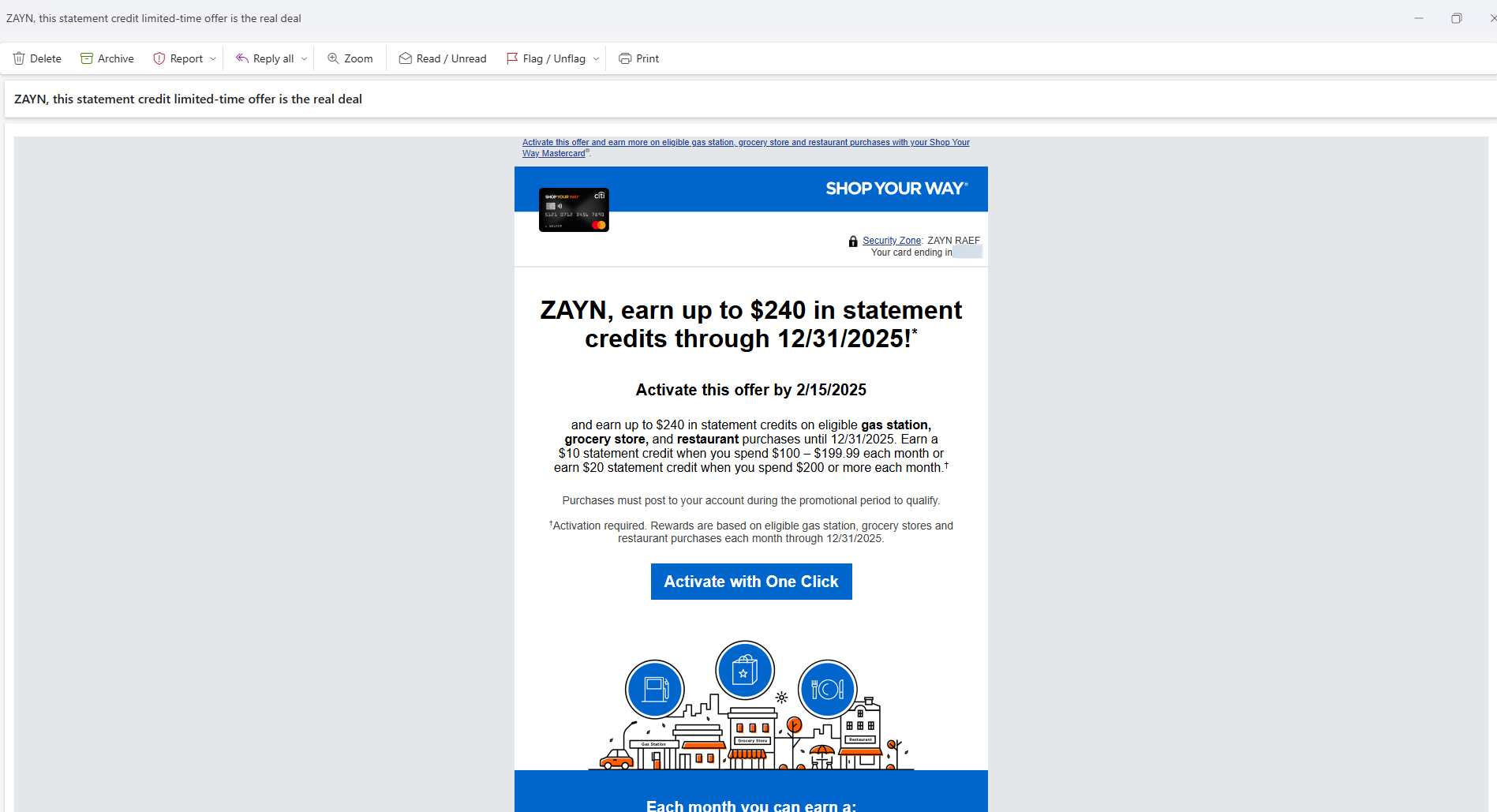

Citi’s spending offers generally fall into one of three formats: elevated rewards in select categories, statement credits for meeting spending thresholds, or bonus points for hitting specific spending amounts. These offers cover a broad range of everyday spending, so there’s likely something useful for just about everyone.

Here are a few of the spending offers I’ve received over the past year with the SYW card:

- Earn a $20 statement credit each month for a full year after spending $200 or more on groceries, gas, and dining

- Earn a $40 statement credit each month for three months after making five or more purchases of at least $75

- Earn 10% back in statement credits (up to $20 per month) for three months after spending $100 or more on home improvement purchases

Here are some of the spending offers other cardholders have reported receiving:

- Get 10% back in statement credits (up to $50 per month) on utility bills — source

- Receive a $250 statement credit after spending $1,000 on online purchases — source

- Get 10% back in statement credits (up to $100 per month) on travel expenses — source

Citi doesn’t send these personalized offers on a fixed schedule, as they’re released sporadically throughout the year. New cardholders typically receive their first offer within 2-3 months, followed by 1–3 offers per quarter based on my experience and multiple data points from other cardholders—though nothing is guaranteed.

The rewards from these offers can easily add up to hundreds, if not thousands, of dollars in value each year. Thankfully, Citi has continued rolling out these generous deals since they started in 2019, with no signs of slowing down. So there’s still time to hop on the gravy train and start racking up some serious rewards.

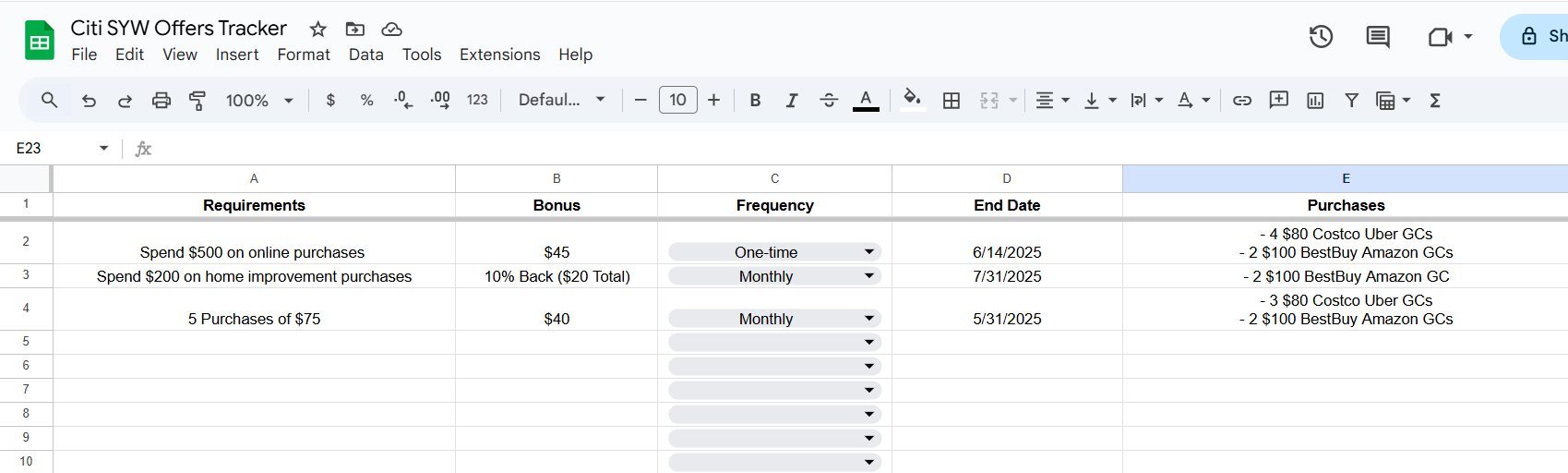

Keeping track of Citi’s offers

Tracking Citi’s spending offers can be incredibly useful, as strategically combining them can help you manage your spending more efficiently.

Here’s how I’m approaching the latest Citi offers on my plate:

My Offers:

- $40 statement credit after making five or more purchases of $75 or more — expires this month

- 10% back in statement credits (up to $20) after spending $100 or more on home improvement purchases — renews monthly, expires next month

- $45 statement credit after spending $500 or more on online purchases — expires next month

My Plan:

- Buy a 2-pack of $50 Uber gift cards from Costco’s website (currently discounted to $80) — counts toward Offers 1 & 3

- Repeat the same Uber gift card purchase — counts toward Offers 1 & 3

- Buy a $100 Amazon gift card from Best Buy’s website (surprisingly codes as home improvement) — counts toward Offers 1, 2 & 3

- Buy a second $100 Amazon gift card from Best Buy — counts toward Offers 1, 3 and completes Offer 2

- Reload $75 to my Amazon balance via their website — completes Offer 1 and contributes to Offer 3

- Buy one more 2-pack of $50 Uber gift cards from Costco after the 14-day cooldown, as the $20 discount is limited to 2 units every 14 days — completes Offer 3

All in all, I’ll earn $105 back on $515 in spending—a cashback rate of about 20%. That’s a solid return, especially since I already spend a fair amount on Amazon and Uber each month.

To stay organized, I use a simple tracker like this. It helps me map out spending combinations and stay on top of my rewards strategy.

Financing Offers

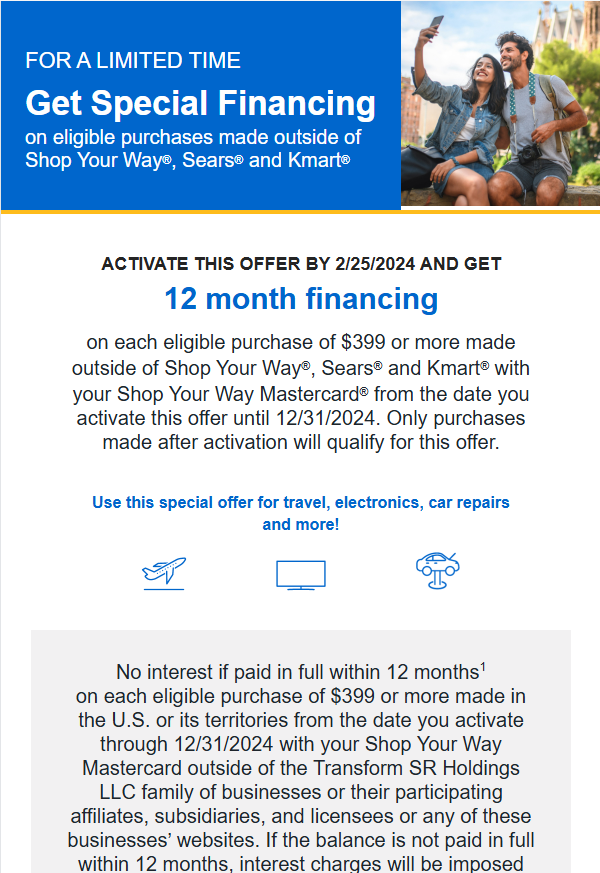

Citi’s offers don’t just stop at spending bonuses but also extend to financing deals.

Here’s a financing promotion I received last year:

- 0% purchase APR for 12 months on all purchases of $399 or more made in 2024 (excluding Kmart and Sears), starting from the purchase date

I took advantage of this offer by putting all purchases of $400+ on my SYW card, and now I’m floating the balance at 0% interest until the promotional rate ends later this year. How cool is that!?

Signup Bonus

What good is a credit card without a signup bonus?

Fortunately, the Citi SYW card has a solid one to sweeten the deal: a $75 statement credit for every $500 spent, up to $225 total.

Bottom Line

The Citi SYW credit card may be one of the most unique offerings in the industry, thanks to its hidden perk: unadvertised, high-value spending offers. This is a sharp departure from most credit cards, which promote their perks front and center in marketing materials. No other card offers such a consistently rewarding spending model—making it an excellent addition to your wallet if you have varied spending throughout the year.

If you’re interested in learning more about credit cards, I’ll leave another post here so you can keep exploring. If you enjoy content like this, feel free to subscribe to my newsletter for more.

And with that, I’ll catch you in the next one. Thanks for reading!